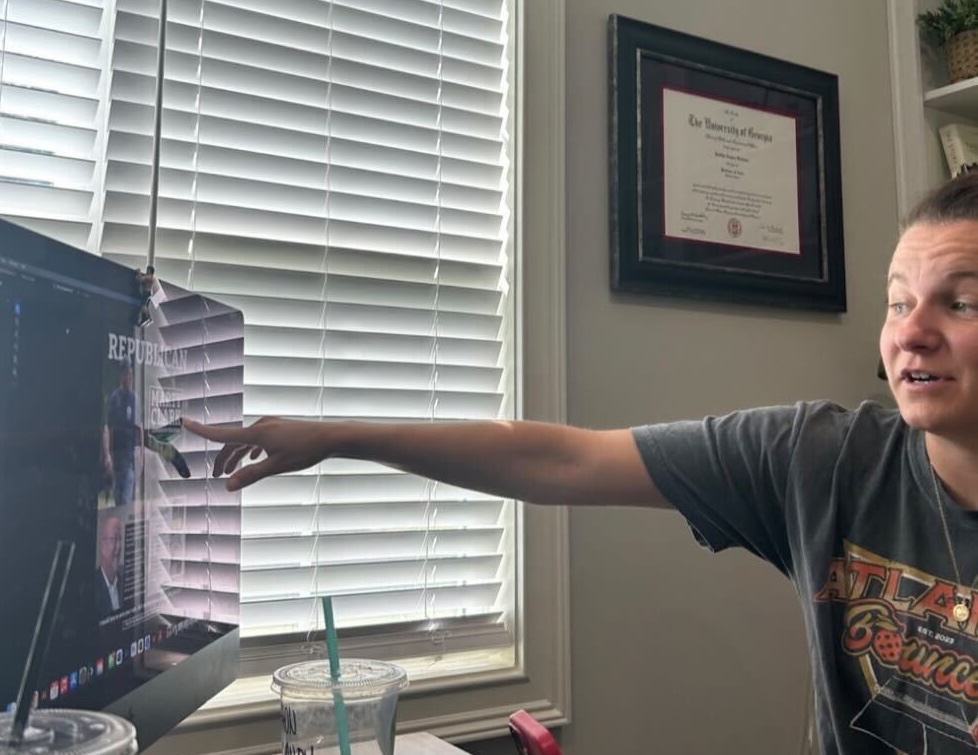

Melinda Lord, director of housing and community development in Athens-Clarke County, discusses how the local government plans to address the current housing crisis.

Q: Can you provide an overview of the current housing crisis in Athens-Clarke County, and how does it compare to trends at the state and national level?

A: So we recently had our affordable housing investment strategy, and it noted an 8,800 unit deficiency in affordable housing in Athens-Clarke County. We referenced that to show this is the number we need, and we don’t have it.

It’s on trend, probably a little higher because of student housing and how it impacts our housing stock in Athens, but it’s still on trend with what we’re seeing nationally not enough affordable housing.

People’s salaries aren’t matching the increase in housing prices.

Q: According to the United States census, 4,121 units of housing in ACC are vacant. How does your agenda help to make these occupied?

A: So if it’s privately owned and it’s a market rate, nothing.

If it’s maybe an apartment complex that’s vacant, and it’s on the market, that’s an acquisition strike fund. If we can find someone who’s interested in putting in some supplemental money to that $1 million to go in and buy that property out, then we can also try to find other funding sources to help go in and rehab it so that it can go back online.

Or we do have money for acquisition with CDBG (Community Development Block Grant) and HOME (HOME Investment Partnerships Program), you can use it for acquisition of property if there is a vacant lot, or if there’s a lot with a house on it that’s on the market, then if our housing partners are interested, they can go in and try to buy it.

Q: What are the biggest obstacles your department faces in addressing the housing crisis?

A: Money, money and money. There’s not enough money to meet the need.

A three bedroom house is about $250,000 (to build), so if you want to sell that house at an affordable rate for somebody who’s at 80% or below area median income, that house is not going to be able to be sold for more than $150,000. If it’s $250,000 to build it, and then you’re selling, we’ve got to lease, put in a $150,000-$200,000 subsidy for that house to get built.

We have, on average, our CDBG is $1.2-1.3 million, and about $580,000-$600,000 of that goes toward affordable housing.

You’re talking maybe six houses, maybe they get developed. Doesn’t doesn’t go very far.

We need more money to be able to put subsidies in place, and that’s why we’re trying to enact the Housing Trust Fund and the Land Bank Authority. We’re trying to come up with ways that we can infuse more money that’s not specifically federal money to support those activities. It would be very helpful if we had more private foundation donations, specifically for affordable housing development that has no ties, no red tape, no bureaucracy that would be great too.

But I mean, honestly, that’s the answer: money.

Comments trimmed for length and clarity.

Sadie Jordan is a public relations major covering local government.

Show Comments (0)