Low supply and high demand have created a national boom in the housing market and as a result, homes have become harder for potential buyers to afford.

From February 2021 to this past February, home prices in Georgia increased by 22% while the number of homes available for sale in the state decreased by 30%, according to Redfin.

The housing market has operated as a “seller’s market” since the beginning of the pandemic, with the demand for homes outweighing the housing supply available for purchase. Wealthy investors buying property in bulk combined with nationwide supply shortages causing a lack of new construction create a difficult situation for those wanting to find new homes.

Mortgage rates continue climbing steadily from the record lows set in 2020, with the Federal Reserve Bank of St. Louis documenting the average 30-year fixed rate as 5.11% as of April 21 of this year. The average dropped as low as 2.67% during the final two weeks of December 2020. However, the residential real estate market remains prosperous due to skyrocketing rental prices in cities and buyers wanting to leave urban areas for more space in suburbs and small towns.

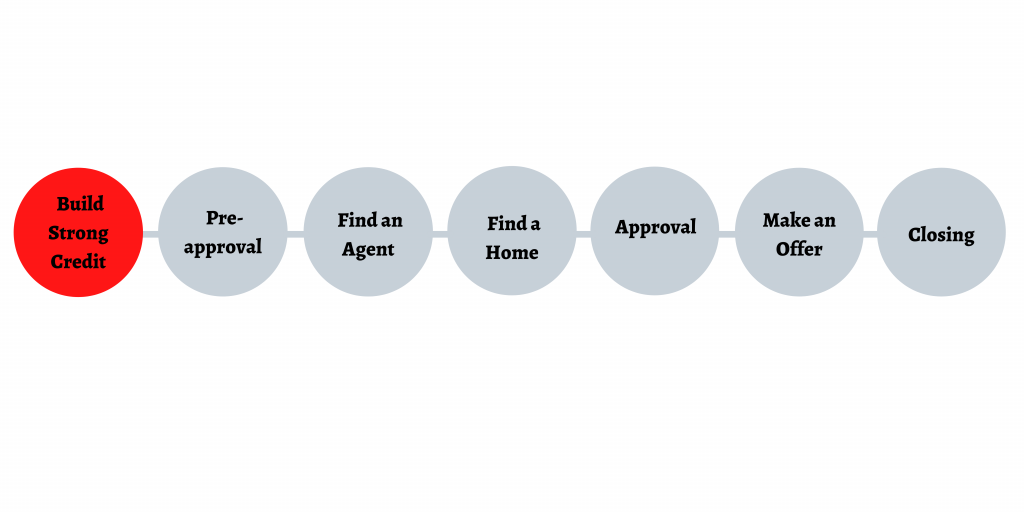

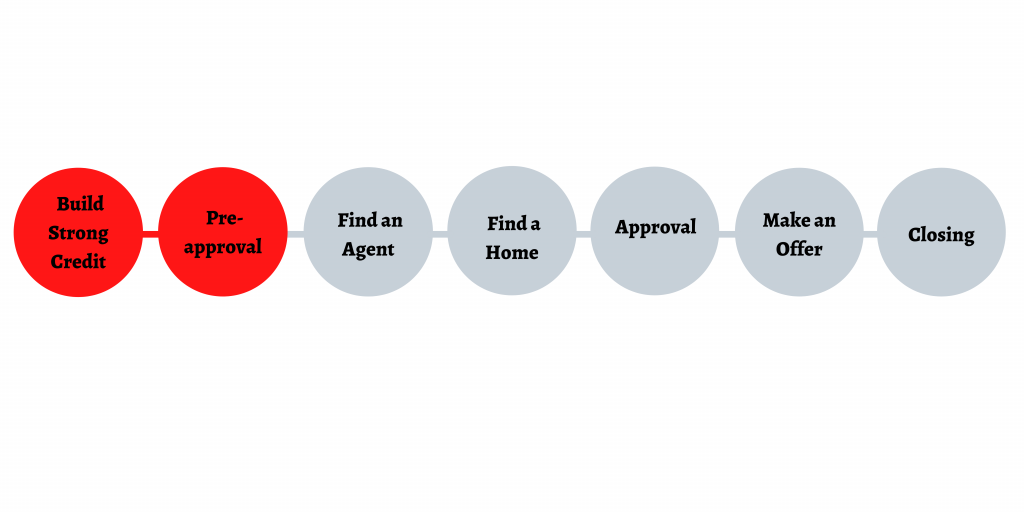

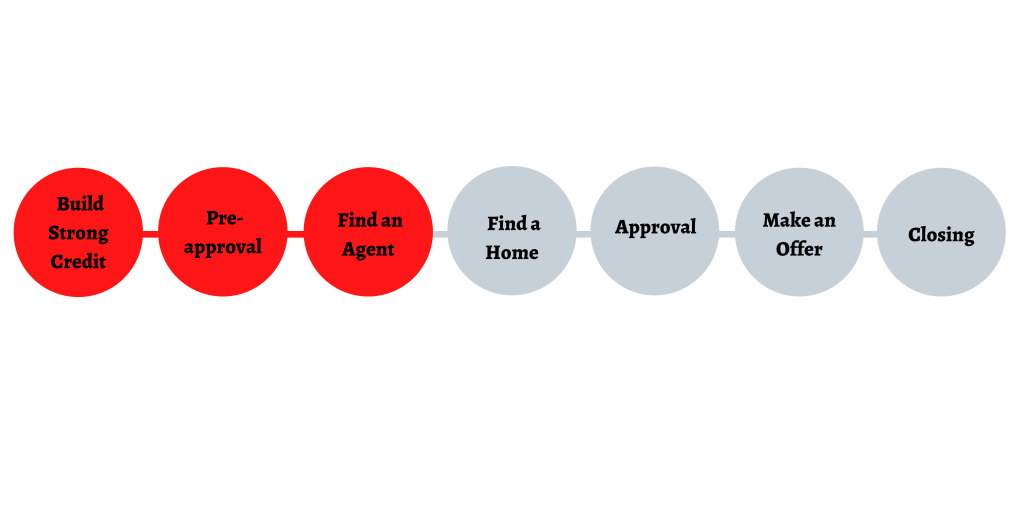

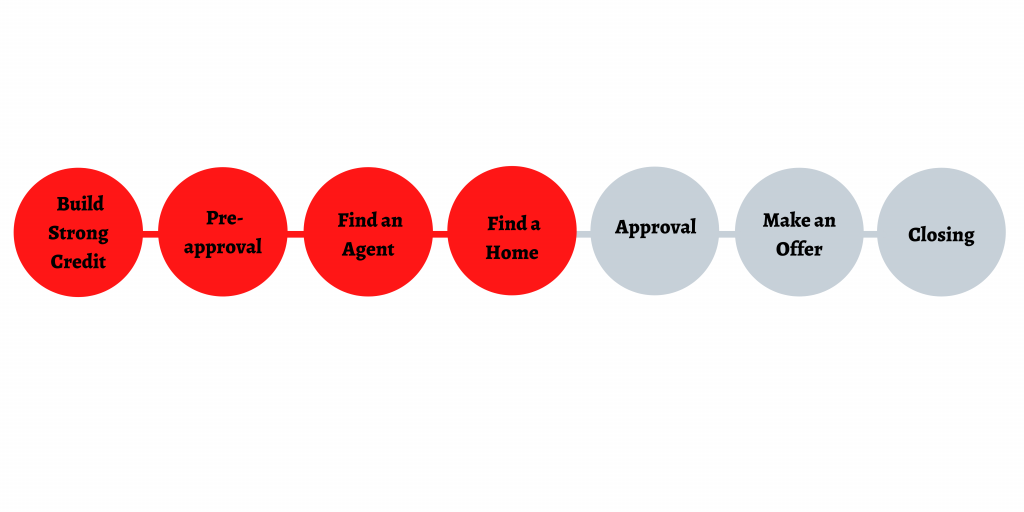

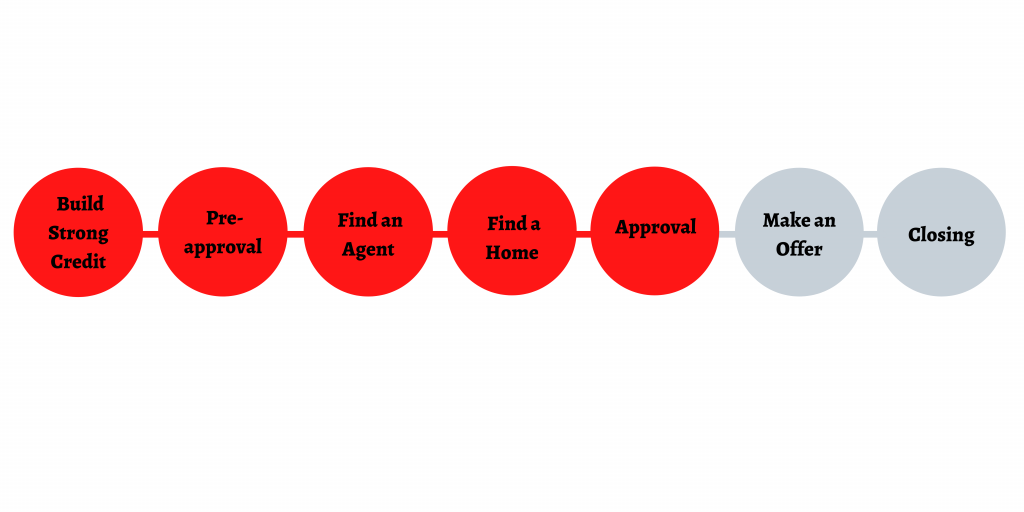

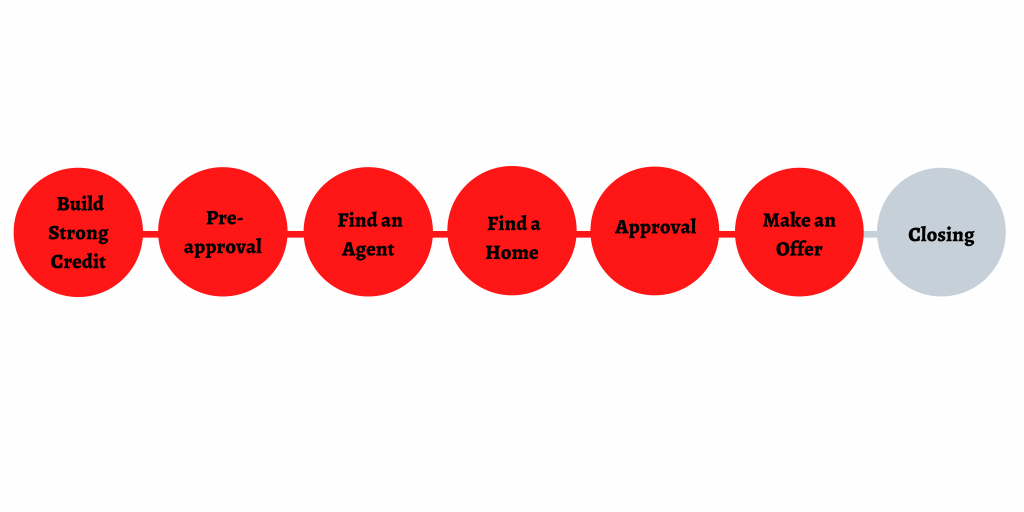

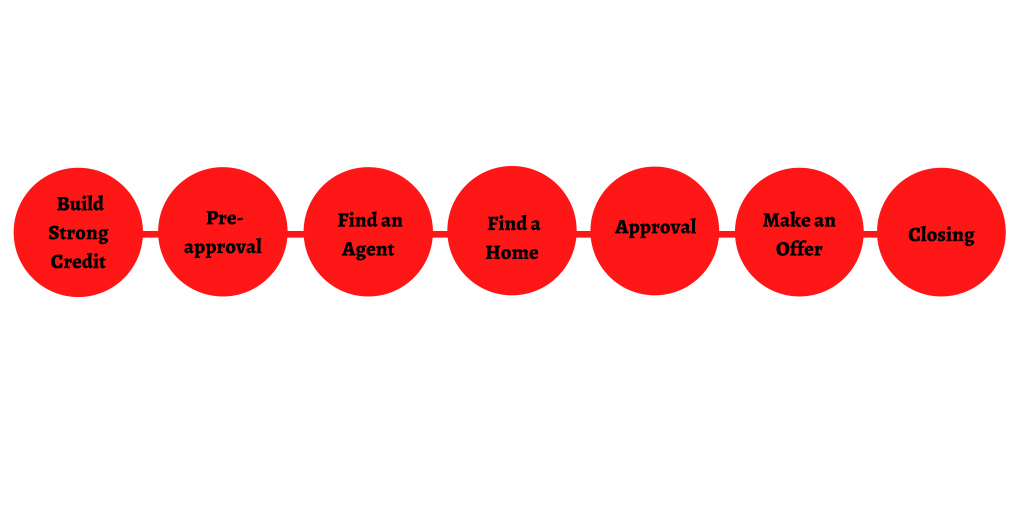

Navigating a seller’s market can be challenging, so here are some tips and a walkthrough on how to purchase a home in a competitive market.

Disclaimer: While these tips are generic, consult a financial advisor and real estate agent for personalized advice on buying a home.

Why It’s Newsworthy: Homebuyers entering the housing market are forced to compete with wealthy investors over a dwindling number of properties, which leads to younger generations with smaller incomes becoming less likely to achieve homeownership.Preliminary Step: Build a Strong Credit Report

In order to receive the best mortgage loan options from banks or personal lenders, a buyer should have a strong credit score.

A credit score is a calculated number ranging from 300 to 850 that is determined by the buyer’s ability to manage their credit. A higher credit score increases the chances of receiving an affordable loan.

According to credit report generator Experian, there are five general factors that affect a credit score: payment history, credit history length, diversity of credit, a credit utilization ratio and the number of open credit accounts.

Credit history length: The age of all credit accounts, from the oldest account to the newest account. An older credit history benefits the overall credit score.

Diversity of credit: The different kinds of debt accumulated and are being paid off. Credit cards, student loans and car loans all classify as different kinds of debt. The more variety a credit portfolio has, the higher the corresponding credit score will be.

Credit utilization ratio: The amount of “revolving” credit currently in use divided by an individual’s credit limit. Revolving credit refers to credit that has no predetermined end date, so debt in the form of credit cards, not mortgage or car loans. A low credit utilization ratio is ideal because it demonstrates an ability to avoid nearing a credit limit.

Number of open credit accounts: Several open accounts can make a credit score drop.

A high credit score is not needed to secure a mortgage loan. However, it can make the process of finding a loan easier.

Get Pre-Approved for a Mortgage Loan

Before making any permanent plans to purchase a specific house, the buyer should ensure their credit is in order by getting pre-approved for a mortgage loan. The pre-approval step is only necessary if the buyer intends to secure a loan to pay for a home.

Pre-approval refers to the process where a lender analyzes a buyer’s financial situation and determines how much money they are willing to lend them to put toward a mortgage. Pre-approvals also determine the interest rate of a buyer’s mortgage loan. Taking this step can make the house hunting process easier by giving the buyer a price range to work with, eliminating options that could be too expensive.

Pre-approvals often begin with the buyer giving a lender a completed mortgage application along with their Social Security number, which the lender will use to evaluate the buyer’s credit. Buyers can send applications to several lenders in order to gather multiple loan offers before choosing the most suitable option for them. According to Investopedia.com, buyers should seek pre-approval anywhere from six months to a year prior to starting a home search. Once a buyer receives a letter confirming they are pre-approved, the buyer typically has 60-90 days to act before the letter expires.

Pre-approval differs from the official approval process. Pre-approval occurs toward the beginning of the home search while the approval occurs after finding a house to put an offer on. A successful pre-approval does not guarantee a successful approval. In fact, it doesn’t guarantee approval at all.

Jonathan Jones, president of Athens Mortgage Resources Inc., said he asks clients about their assets, jobs, and monthly debts when he first meets them to discuss loans.

Jones also said potential buyers should feel comfortable with the lender they’re negotiating with. Vouch for meeting with a lender in person rather than sorting out business entirely online.

“The technology doesn’t always pay off in price,” he said. “It’s still a people person’s business.”

Find a Real Estate Agent

Over a dozen real estate agencies serve the Athens area alone, each employing diverse teams of agents with varying backgrounds and areas of expertise. Ask family members or friends for agent recommendations, but also do some research of your own. Agency websites, personal portfolios and social media are all ways to learn about specific agents in a community.

Sylvan Cown, broker of Own Town Realty in Athens, said interviewing an agent is a great way for a buyer to determine if they are a good fit. She said taking the time to find the right agent is important because the relationship between the buyer and the agent could last several months.

“(The buyer doesn’t) have to just sign up and say, ‘Hey, I’m looking for a Realtor,’” Cown said. “But (say to the agent), ‘I’d like to talk to you and just see how we click.’”

Ian Keane, one of Cown’s recent clients, said he had known Cown since he was a teenager. Keane said this relationship influenced his decision to select Cown as his agent.

“I used to carpool with her and her daughter to school when I was in high school,” Keane said. “She knows my parents and that’s how I came to use her services.”

Search for a Home

If starting from scratch, online marketplaces like Redfin are a way to learn about available homes in a specific region. Normally, once a buyer hires an agent, the buyer should be descriptive in telling the agent what they’re looking for in a home, from the ideal square footage to the materials used in the interior and exterior of the home.

In a seller’s market however, buyers generally have less room to be picky with preferences. So, be prepared to sacrifice items on your wish list in order to go forward with purchasing a home.

Cown said previous clients would filter her house search drastically by giving her detailed requests to abide by. Now, price range serves as one of few factors of concern for buyers when house hunting.

Keane’s home buying experience was different. He said the house he ended up purchasing fulfilled many of his initial requests, making his first home one he can grow into over the next few years.

“I got a house that fits me really well,” Keane said. “(The house) really suits my aesthetic preferences, it’s located in an area I like (and) it’s large enough.”

Keane was able to place an offer on the home because its owner relisted the property after a previous deal fell through. Keane said the owner was dedicated to selling her house to an individual buyer rather than an investor, which worked in Keane’s favor.

Get Approved for a Mortgage Loan

After finding a house to place an offer on, it’s time to officially become approved for a mortgage loan.

The approval process resembles the pre-approval process in the sense that a lender analyzes the buyer’s credit to ensure they are financially stable enough to handle monthly mortgage payments.

Cown said the lender and agent look for a “clear to close” during this procedure, which would allow the buyer to transition to the final steps of the home buying process.

Make an Offer

Making an offer on a home is one of the most challenging steps of buying a home in a seller’s market. With more buyers on the market than available houses, it’s likely other people will also place offers on a home that a buyer is interested in. Because of this, an offer should be competitive.

Cash offers are even more promising. Cown said she has witnessed sellers accept full cash offers below the asking price of a property in order to avoid the hassle of the loan payment process.

Seller’s markets operate in favor of sellers because a lack of housing causes sellers to exert more control over pricing. Buyers generally have a smaller chance of purchasing a house for less than the listed price because high demand drives up prices to eliminate competition. In fact, houses are susceptible to bidding wars in a seller’s market, where houses can sell for over tens of thousands of dollars above the original asking price.

“You better have a lot of money to put down,” Jones said about affording a home in the current real estate market. “Don’t think you’re really going to negotiate [with sellers over offers].”

Closing

Since the start of the housing boom, buyers have rushed through the closing process to prevent larger offers from halting their contracts, yet another side effect of a seller’s market.

Under normal circumstances, the buyer sets a date to close and schedules a due diligence period, which can last up to 14 days. During this period of time, the buyer gets the house inspected for construction issues, pests and any other hazards that need to be addressed. Cown said this is an important phase of the buying process, but it’s one that has been frequently overlooked over the past year.

Cown said some buyers have forgoed the due diligence process entirely, sacrificing a proper inspection of the property to increase their chances of closing. Cown also said buyers and investors in larger markets have offered to purchase property in cash with no contingencies attached. With fewer to no contingencies, contracts can become legally binding even quicker than usual. These shortcuts can work against buyers with stricter, smaller budgets, while benefiting buyers with more money to spend.

Cown said that these cut corners in the traditional real estate procedure created a phenomenon completely unfamiliar to her.

“I’ve never seen any of this in my 20-something years until I started to see all of this about a year ago,” Cown said. “That’s when it came into effect here.”

It’s unclear how long this housing boom will last and some analysts aren’t expecting a turnaround anytime soon. Researchers at the Federal Reserve Bank of Dallas predicted a housing bubble will emerge if house-price appreciation continues to accelerate. The country’s last housing bubble ended in a bust as the 2008 financial crisis led to widespread foreclosures and overall economic stagnation. However, the researchers believe this new potential housing bubble would not bear the same effects as the bubble from the mid-2000s.

Regardless, the housing market will likely continue to favor sellers as contractors struggle to build new homes to accommodate high demand. Potential buyers still shouldn’t feel completely discouraged by the volatility of the current market, because success stories like Keane’s are still possible.

“I’m not really planning to buy more property or move anytime in the future,” Keane said. “I’m actually really happy with this property in (East Point) and living here so far.”

Janelle Ward is a senior majoring in journalism and history.

Show Comments (1)

Tunnel Vision Goggles

You are buying a home in a competitive market means you need to know what you want, what you need, and what you absolutely can’t live without. As a buyer, you’ll want to purchase a home in a buyer’s market, as there will be an influx of available homes and less competition.