ATHENS-The Athens-Clarke County Police Department has cautioned taxpayers to remain on alert as April 15th, the filing deadline for U.S. federal income tax, approaches. IRS scams have taken over half a million dollars from Georgia residents since October 2013.

An official for the Treasury Inspector General for Tax Administration, or TIGTA, said in an email to Grady Newsource today that “according to most recent information, 115 Georgia residents have reported losses of $637,677 due to this scam.” TIGTA also claimed it does not have the information broken down by county or city.

Further, TIGTA also announced additional outreach efforts to prevent individuals from falling victim to criminals who impersonate Internal Revenue Service and Treasury employees this filing season. This includes video Public Service Announcements in English and in Spanish that warn taxpayers about the scam.

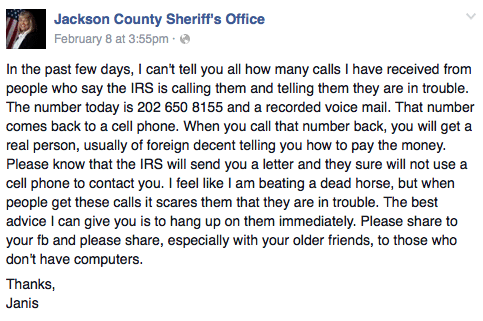

These scams have worried other counties in Georgia, including Jackson County.

Here is what you need to know:

The IRS generally first contacts people by mail – not by phone – about unpaid taxes, and the IRS will not ask for payment using a prepaid debit card, a money order, or a wire a transfer. The IRS also will not ask for a credit card number over the phone. The callers who commit this fraud often:

-Utilize an automated robocall machine.

-Use common names and fake IRS badge numbers.

-May know the last four digits of the victim’s Social Security Number.

-Make caller ID information appear as if the IRS is calling.

-Aggressively demand immediate payment to avoid being criminally charged or arrested.

-Claim that hanging up the telephone will cause the immediate issuance of an arrest warrant for unpaid taxes.

-Send bogus IRS e-mails to support their scam.

-Call a second or third time claiming to be the police or department of motor vehicles, and the caller ID again supports their claim.

If you get a call from someone claiming to be with the IRS asking for a payment, here’s what to do:

If you owe Federal taxes, or think you might owe taxes, hang up and call the IRS at 800-829-1040. IRS workers can help you with your payment questions.

If you do not owe taxes, fill out the “IRS Impersonation Scam” form on TIGTA’s website or call TIGTA at 800-366-4484.

You can also file a complaint with the Federal Trade Commission www.FTC.gov. Add “IRS Telephone Scam” to the comments in your complaint.

If you have questions about these scams contact ACC PD Sgt. Michael York at 706-208-1718 X224.

By: Fernanda Perez

Contributed: SK Bowen